- For electricity consumed by data centers for carrying out information processing services or server rental services, companies are entitled to a tax reduction for energy tax paid that exceeds 8 000 SEK/year. The total installed capacity of such data centers must be at least 0.1 MW for equipment, not including cooling and fan systems.

Sweden Energy Market Energy Tax on Electricity

Share on LinkedIn11 Feb 2021

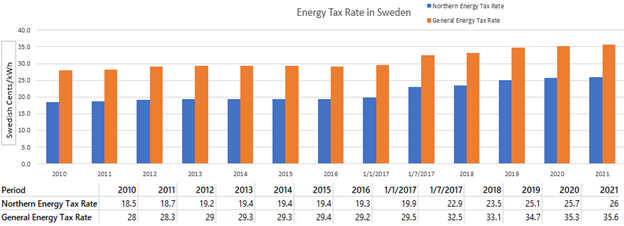

All electricity consumed in Sweden is taxable. The energy tax rate for electricity continued to grow over the past decade. In 2021, the energy tax rate is 35,6 Swedish cents/kWh. However, not all companies are paying this rate.

All electricity consumed in Sweden is taxable. The energy tax rate for electricity continued to grow over the past decade. In 2021, the energy tax rate is 35,6 Swedish cents/kWh. However, not all companies are paying this rate. Swedish law and regulations provide specific tax reductions and exemptions to certain companies. These tax incentives are based on the type of the business and the location of a business.

Overview: The Energy Tax on Electricity in Sweden

Although Sweden has one of the highest energy tax rates on electricity globally, political acceptance has remained high. As environmental concerns are a top priority for the nation, energy tax policies were introduced to incentivize energy efficiency. Research shows such policies have effectively reduced GHG emissions over the past several years. The Swedish energy tax system is difficult to navigate for a few reasons:

- Government policies provide tax reductions and exemptions only to certain industries and companies as an incentive.

- The government continues to revise existing and issue new policies regarding tax reduction and exemption opportunities for different sectors.

- The law grants tax deductions for certain areas in the northern region to reflect the climate and temperature differences, i.e., colder regions receive lower tax rates as companies must consume more energy for heating purposes.

- The law imposes lower tax rates on green energy generation than on conventional sources.

Due to the complexity, many companies and even utilities struggle to stay updated on energy tax developments. For example, under the new rule, a full energy tax is charged on each utility invoice. Eligible companies are responsible for applying for any refund from the Swedish Tax Agency annually or monthly, depending on the entity’s electricity consumption, in effect, moving the administrative burden from the government to consumers. Not surprisingly, some companies have been missing out on these cost-reduction opportunities.

Tax Reduction and Exemption Opportunities Based on Business Types

Depending on the industry and specific business activities, companies may be qualified for a tax reduction or a tax exemption. Tax savings achieved can be significant and usually create major competitive advantages for those companies.

I. Tax Reduction: Energy Tax Rate Reduced to 0,6 Swedish Cents/kWh

- For electricity consumed in the industrial manufacturing process, companies are entitled to a tax reduction for energy tax paid that exceeds 8 000 SEK/year.

- For electricity consumed in professional agricultural, forestry and aquaculture activities, including professional greenhouse cultivation.

- For electricity consumed by data centers for carrying out information processing services or server rental services, companies are entitled to a tax reduction for energy tax paid that exceeds 8 000 SEK/year. The total installed capacity of such data centers must be at least 0.1 MW for equipment, not including cooling and fan systems.

- For electricity consumed by data centers for heating and cooling, companies are entitled to a tax reduction for energy tax paid that exceeds 2 000 SEK/quarter.

- For electricity consumed by ships from land power.

II. Tax Exemption: Energy Tax Rate Reduced to Zero Swedish Cents/kWh

- For electricity consumed by train or other rail-bound means of transportation for motor operation or heating in immediate connection with such use.

- For electricity consumed mainly for chemical reduction or electrolytic processes.

- For electricity consumed in the process of generating energy products.

- For electricity consumed in the metallurgical processes or in the manufacture of mineral products, provided that the constituent material has been chemically altered through heating in furnaces or its internal physical structure has been altered.

Tax Reduction Opportunities Based on Business Locations

The energy tax rate applied in certain northern regions for companies in the service sector should be 26,0 Swedish cents/kWh, excluding VAT, in 2021, which has been consistently lower than in the rest of the country. Sweden's government adjusted the rates to show social equity priorities. Companies qualified for location-based energy tax reduction should see such reduction on their electricity network invoices automatically without an application. It is worth mentioning that EU state aid rules apply to this tax reduction – it may not be given to companies in financial difficulties, either directly on the electricity network invoices or via efunds from the Swedish Tax Agency. Although the location-based tax reduction should be applied to companies’ electricity network invoices automatically, companies still need to pay close attention to these charges. We have noticed several utility companies have not been able to follow and adapt many new and intricate rules, resulting in billing errors. This tax reduction does not prevent eligible companies from applying for the business type based tax reduction or tax exemption.

The following counties and municipalities are entitled to the northern tax reduction:

- Dalarna County: Malung-Sälen, Mora, Orsa and Älvdalen

- Gävleborg County: Ljusdal

- Jämtland County: all municipalities

- Norrbotten County: all municipalities

- Värmland County: Torsby

- Västerbotten County: all municipalities

- Västernorrland County: Sollefteå, Ånge and Örnsköldsvik

NUS Consulting Group Can Help You Maximize Tax Reduction and Exemption Value

The Swedish energy tax scheme is intricate. Identifying applicable tax reduction and exemption rules requires time, resources and expertise. It has been our experience that many companies either do not have the expertise to enter or can’t successfully navigate this tax labyrinth. NUS Consulting Group is experienced in helping clients obtaining the most optimal tax reduction and exemption opportunities in the Swedish market. Our energy tax experts maintain a comprehensive rate library and closely monitor any regulatory and policy updates on the national, regional and local levels to ensure we assist clients in obtaining the best rate at the right time and in the right way. NUS handles the entire application process, including various administrative work, communication with electricity supplies and Swedish Tax Agency, and consumption reporting. Our service can effectively manage risks, maximize the refund result and enable your team to focus on your core business processes.